Triple the Sequester

President Obama isn’t the only one with a road show warning of the coming sequester’s dire, a-two-percent-cut-means-Hoovervilles consequences. Governors O’Malley (D-Maryland) and McDonnell (R-Virginia) have hit the airwaves and op-ed pages with laments over the impending collapse of their economies. I suppose governors are supposed to be beggars; and to the extent that federal funds are our federalism’s lifeblood, Messrs. O’Malley and McDonnell qualify as “federalists.” That said, their conduct is disgusting.

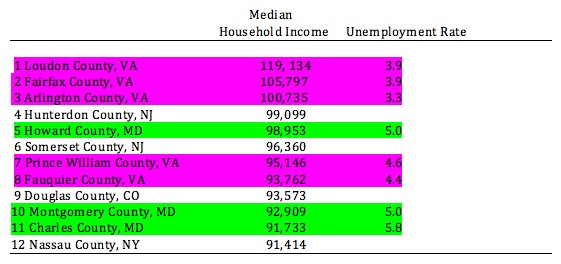

Listed below are the nation’s top twelve counties in terms of median household income (Census Bureau data; national average in 2011: $50,502), along with the unemployment rate for the Virginia and Maryland counties in the group as reported by the Bureau of Labor Statistics (national average at the time: 7.9%). Virginia counties appear in pink; Maryland counties in green. All are clustered around the nation’s capital:

Eight out of twelve. Not bad.

Everyone knows where this stupendous wealth, unfathomable in most of the country, comes from: federal jobs; federal contractors; federal rent-seekers (armies of lawyers, lobbyists, and consultants); and federal transfers. Our fabulous fiscal federalism follows a general pattern: states with lots of high-income earners (Connecticut, Delaware, California, Connecticut, New Jersey) transfer funds to those without. The only outliers are Virginia and Maryland: they’re among the richest states and among the largest net recipients of federal largesse, with a net transfer ratio that places them in the company of South Dakota and Mississippi. We (“we” because I live and prosper in Fairfax County) create wealth by sucking it out of the rest of the country, to the tune of tens of billions per year.

On the upside, the system creates an appreciable degree of financial stability. We should not sequester funds so soon after a crisis and in a faltering economy, we hear from Krugman, Klein & Company. However, fiscal crises and job losses happen in the newspapers, not here. At four percent “unemployment” jobs go begging, and every time you drive down Route 1 (“the armpit of Fairfax County,” as it’s affectionately known) there’s a new Mercedes dealership. We also have a Beemer shop, for the janitors.

On the downside, you can’t win a golf tournament here. Maryland and Virginia lead the nation not only in federal transfers for defense work but also in federal retirement pay. Every time you tee up you run into a 42-year-old retiree in top physical condition who divides his week between consulting (5 hours) and the Army-Navy Club (40 hours). Nice work, if you can get it.

It would be wrong to call this a European social model. It’s the model European countries would love to have but can’t. We have a vast hinterland to exploit; they don’t.

You—you out there—can’t do anything about it. The system is entrenched, and rival centers of wealth and power have long been coopted. (Citibank and NYU pay our emissaries seven-figure salaries for doing nothing, just to stay in our good graces.) Perhaps, though, there is still time to ask our governors and their constituents a question Bill Voegeli has urged upon supporters of the welfare state: How much is enough? What federally financed and leveraged median income would you consider acceptable? Evidently, twice the national average doesn’t do it; would three? Four? If a 1.3 or 1.5 federal balance-of-payment ratio doesn’t do it for you, would 2.0 be acceptable?

We’re not begrudging you your place as the biggest pigs at the federal teat. Just give us a number, and then stop squealing.