There's always hope that we might eventually turn the Constitution right-side up again.

Michael S. Greve

We must approach the Constitution in the spirit that inheres in the document itself.

If government has to screw up, as invariably it will, it’s best not to do it all over the place, all at once.

Do partisans of the administrative state really want to give up power?

Like it or not, administrative institutions dominate our politics. But does that mean we should trust an independent "fourth branch"?

A gathering at George Mason University to remember the late, great judge.

Cyclical predictions only carry us so far. And so, therefore, do predictions of a second Progressive era.

Remembering a brilliant jurist, scholar of Russian history, and friend.

The difficulty is that APA originalism runs up against the constitutionalist position at every turn.

We’re all in a maudlin mood: we should use it to think about what really matters.

The natural intuition is to think that federalism works in normal times and then gets in the way of prompt, effective responses to crises.

Michael Greve discusses the daunting prospects for the Roberts Court in a closely divided country.

A Republic, if You Can Keep It isn’t a vanity project; it’s a serious work of civic education.

Michael Uhlmann, a lawyer, professor, and mentor to many, is remembered by Michael Greve.

The irony: that legal conservatism seems to have triumphed now, at a moment when the political conditions that initially spurred it have ceased to obtain.

Justice Stevens was a crafty manipulator and a tireless champion for the regulatory state and its constituencies, foremost the trial lawyers.

Once you think about where originalism came from and what it was supposed to do, you begin to suspect that it may have run its course.

Congress will not perform an unnatural act (i.e. legislate), so those who would control the President's power must sue.

Bruce Springsteen offers a sustained prayer to his Holy Mother and his country, without irony or cynicism. He can't think that way—and good for him.

I am willing to gamble that a new Administrative Judiciary would, over time, develop a sensible, rights-centered body of law.

Only a new administrative judiciary can tame the regulatory state.

It has no logical stopping point. Collective political decisions always leave someone worse off, even when they are made at a neighborhood level.

It’s way too late to insist that our elected officials can’t just make up stuff. But there ought to remain a difference between a tweet and a federal lawsuit.

In Epic Systems Corp. v. Lewis, the Federal Arbitration Act offered the court a second-best workaround to Erie's formless wasteland.

From bitter experience the Social-Democrats know that life in Mrs. Merkel’s political embrace is a kiss of the spider woman: you slowly die.

Blue state leaders and public sector unions stand a lot to lose from SALT, and they know it.

The incoming President’s consiglieri will be smart enough to surround themselves with fall guys and gals.

Among the most destructive consequences of “cooperative” federalism is its tendency to foster a social structure resembling that of Tunisia or Argentina.

I can tell you when I knew the game was up for those hacks in the East.

Without the default rule established in McCulloch v. Maryland, the states would make mincemeat of the federal structure.

At the centennial of the 1912 election, pundits and politicos tell us, we again confront a constitutional moment. For the Right, the existential choice is between entrepreneurialism or social democracy, America or Europe. For the Left, it is between the 99 and 1 percent or, in President Obama’s less unhinged version, between a common future that’s “built to last” and unbridled, destructive capitalism.

There’s been a lot of talk that our federalism might come to look like the EU, with Illinois starring in the role of Greece or Italy. However, the institutional differences are far too great for meaningful comparison. For example, Chancellor Merkel can depose the Italian Prime Minister with a phone call; our Constitution does not give the President, the Congress, or for that matter the National Governors Association any such agency in the affairs of a member-state. For another example, the EU (outside the egregious but fairly small Common Agricultural Policy and a few other slush funds) isn’t a transfer union. Our federalism is or rather has become that sort of union. That doesn’t mean we have a smaller problem than the EU; it just means that we have a different problem. For purposes of comparison and instruction, you want to look at a federal system that shares our problem. Come visit Argentina: you’ll see the future, and it doesn’t work. Read more

Yesterday’s post, on the seemingly unstoppable growth of federal transfer payments to state and local governments, ended on a question: what happens when both parties to the transaction, the states and the feds confront unsustainable commitments? The brilliant answer our federalism has produced: make yet more unsustainable commitments. Why? Read on to find out.

President Obama didn’t discuss the nation’s massive, swelling debt in his State of the Union address. Mitch Daniels did, and good for him: the flood of red ink really is the Niagara. Our accelerating drift toard the cliff, moreover, entails not only fiscal and economic but also institutional and constitutional consequences of grave import. State and local debts are a comparatively small tributary to the great stream, but they illustrate the point. State and local debts are composed of about upwards of $4 trillion in unfunded pension obligations; upwards of a half-trillion in other pension benefit obligations (mostly for health benefits), also unfunded; and about $2.9 trillion in municipal (state and local bonds). These debts will not be paid (at least not in real dollars), because they cannot be paid. The question is how and to whom our federal system is going to administer the haircut—and what changes it is likely to undergo in the process. Today’s post deals with the background causes and conditions of state debt; tomorrow’s, with federal bailouts; Monday’s, with fiscal federalism’s future. (It’s not the EU. It’s Argentina.) Read more

My colleague Alex Brill has come up with a revenue-neutral plan to make the tax code more progressive and pro-growth. Among his six proposals: phase out the federal deduction for state and local taxes. Read on to find out why this is a good idea.

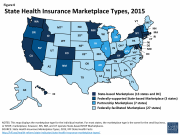

This past Friday, the U.S. Department of Health and Human Services (HHS) postponed for a year (until August 2013) the effective date for an interim final rule (IFR) that would require many religious employers to cover under their health insurance plans preventive pregnancy services, from contraceptives to sterilization and “morning-after” pills.

Having had my fun at the European Union’s expense, perhaps it’s time to move past Lufthansa jokes (although I do have a few more) and pay more serious attention to the EU and its federalism. There’s little room for American gloating or Schadenfreude: the ongoing EU disaster is hanging over our economy; and besides, our own federalism isn’t in such terrific shape, either. Read on to learn more.

My ten-year-old son just informed me that not only Wikipedia but also Minecraft and other sites have temporarily gone dark in protest of SOPA and PIPA. What’s that, he wants to know. Read more to find out.

In the pending Obamacare litigation, the plaintiff-states argue that Title II of the Affordable Care Act (“Obamacaid”) unconstitutionally “coerces” them to participate in a grand expansion of Medicaid. I’ve argued here and there that the plaintiffs will and should lose that argument. A terrific amicus brief by Vanderbilt Law School professor James Blumstein makes a powerful case on the other side. Ultimately, Jim’s brief doesn’t fully persuade me. But it comes very, very close on account of its recognition that Obamacaid’s crucial problem has to do with the bilateral risk of opportunistic defection from a pre-existing, quasi-contractual relation (Medicaid), not with some “economic coercion” story about federalism’s “balance” and the poor, pitiful states and their faithful public servants. (For ConLaw dorks: the key cases are Pennhurst and Printz, not South Dakota v. Dole or Steward Machine.) I hope to explain sometime next week; today, a few additional remarks on economic coercion. Read more

The shipwreck off the Italian coast, Bret Stephens writes in the Wall Street Journal, is an apt metaphor for the entire continent. Read more to find out why.

The Washington Post reports that federal-state plans for a high-speed train connecting San Francisco with Los Angles and points in-between may never come off the ground. In the face of public resistance, the state may have to decline some $3.5 billion in federal “stimulus” funds dedicated to an initial segment of the line, connecting the thriving metropolises of Bakersfield and Merced. We may be witnessing an outbreak of fiscal and institutional sanity. Keep reading to learn more.

Briefs have been trickling into the U.S. Supreme Court in the Obamacare cases. Soon, they’ll come flooding: briefing on the Affordable Care Act’s individual mandate is starting today. It’s important to recognize that the constitutional arguments in the cases don’t always mesh easily with conservative-libertarian opposition to Obamacare’s policy—or for that matter, with their concerns over the state and trajectory of American federalism. Continue reading to learn more.

Many of my contributions to this blog will riff my forthcoming tome on the Constitution and its federalism, cleverly entitled The Upside-Down Constitution. The publisher’s (Harvard University Press) release date is February 15. However, you can already pre-order the book on Amazon.com. What exactly is “upside-down” about our Constitution? Keep reading to find out.

The point of this enterprise, as I see it, is to revitalize and elevate a constitutional debate that, in my estimation, has gotten bogged down. On the political Left, constitutional theory has to satisfy a vast range of “progressive” policy commitments before it can get a hearing. On the Right, a well-intentioned insistence on interpreting the Constitution one clause at a time has been taken to excess. In the process, it has crowded out a proper and urgent appreciation of the Constitution’s broader purposes—its “genius,” as John Marshall used to say.

Michael S. Greve is Professor of Law at Antonin Scalia Law School. His numerous publications include The Upside-Down Constitution (Harvard University Press, 2012).