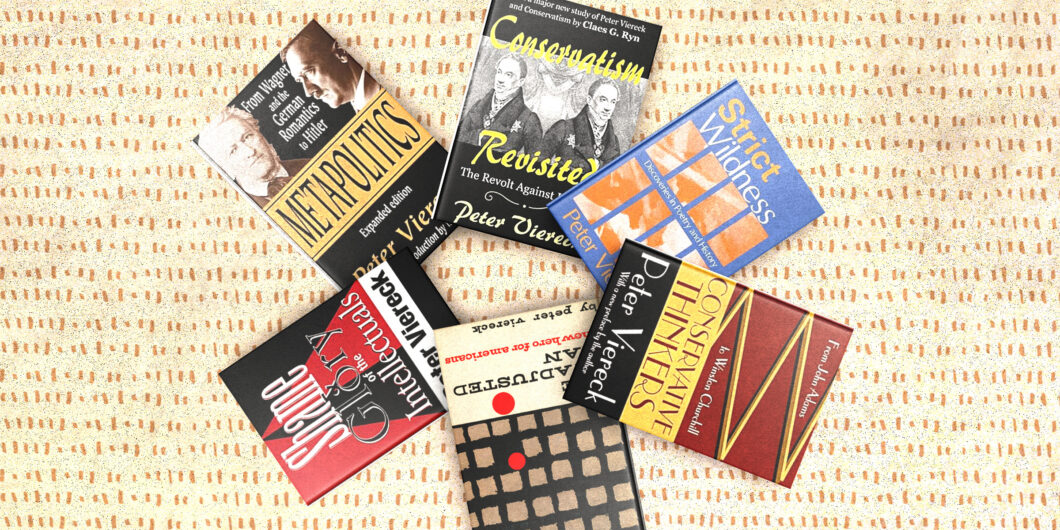

One of the most insightful figures in postwar conservatism has been forgotten in our age of political chaos.

Federal Reserve

Recent

Corruption and economic centralization are a match made in hell.

The past two decades on the American right have been an extended exercise in mapping out Hayek's road to serfdom.

California’s new cultural competency requirement for pharmacists is totalitarianism based on the hierarchy of race, sex, and gender.

Patricia Highsmith and her character Tom Ripley both lived behind metaphysical masks.

Market discipline is possible only with rules that make it clear to all concerned who is offering the best value to patients.

Today's Academic Left are people of action, not ideas.

Government interventions, in attempting to artificially allocate resources, actually help fuel inequality.

A newsletter worth reading.

The television series Manhunt reassures viewers of American triumph without wrestling with its great conflicts.

The formal equality of opportunity that we already have is the only form of it that is not inherently tyrannical.

Counter-speech is a mechanism used by traditionally marginalized individuals to contest allegedly harmful speech.

Land acknowledgments amount to the hollow incantations of hollow people.